Nova Agritech, a prominent player in the agri-input sector, is set to embark on a new phase with its Initial Public Offering (IPO) valued at ₹143.81 crore. The IPO, comprising a fresh issue of ₹112 crore and an offer-for-sale (OFS) of 7,758,620 equity shares, has already stirred excitement in the market. With Nova Agritech IPO’s Grey Market Premium (GMP) standing at +20, indicating a ₹20 premium in the grey market, investors are keenly watching this offering. In this comprehensive exploration, we delve into the details of Nova Agritech IPO, analyzing its prospects, subscription dates, and the factors contributing to its GMP.

Table of Contents

The Rescheduled Subscription Dates

The Nova Agritech IPO, initially slated to open on Monday, January 22, faced a rescheduling due to a public holiday commemorating the inauguration of the Ram Temple in Ayodhya. The subscription period has now been rescheduled to start on Tuesday, January 23, and will conclude on Thursday, January 25. This delay has added anticipation to the IPO, with investors eager to participate in this agricultural venture.

Pricing Details of Nova Agritech IPO

The Nova Agritech IPO price band has been set at ₹39 to ₹41 per equity share, with a lot size of 365 equity shares and multiples thereof. The net proceeds from the IPO will be strategically utilized, including investments in subsidiary Nova Agri Sciences Private Limited for a new formula factory, financing capital expenditures for the expansion of an existing formula plant, and meeting working capital needs.

Grey Market Premium (GMP) Overview

The GMP of Nova Agritech IPO stands at +20, indicating a premium of ₹20 in the grey market. This premium reflects investors’ readiness to pay over the issue price, projecting positive sentiments towards the company’s future performance. Considering the upper end of the IPO price band and the current GMP, the estimated listing price indicates a significant 48.78% increase.

IPO Subscription and Allotment

As the subscription window opens, investors are expected to show considerable interest in Nova Agritech IPO. The IPO has reserved shares for qualified institutional buyers (QIBs), non-institutional investors (NIIs), and retail investors, ensuring a diverse participation. The allotment process will follow the subscription period, determining the number of shares allocated to each category of investors.

Company Overview and Specialization

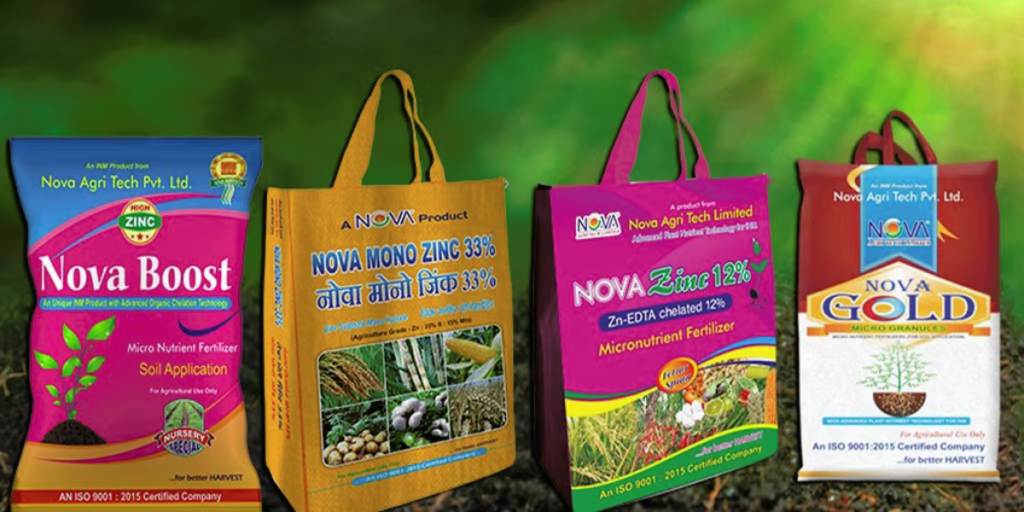

Nova Agritech, as an agri-input company, specializes in crop protection, crop nutrition, and soil health management. The company adopts a tech-driven, farmer-centric approach to provide nutritionally balanced and environmentally sustainable products. With a robust focus on research and development, Nova Agritech has positioned itself as a one-stop solution for farmers’ needs.

Financial Performance and Growth Prospects

Over the last three years, Nova Agritech has demonstrated steady growth and exceptional financial performance. The company’s comprehensive farmer outreach program, coupled with a well-established distribution network, ensures high product acceptability. The net profit margins have seen commendable expansion, reflecting the company’s efficient financial management.

Key Risks and Considerations

While Nova Agritech presents a promising investment opportunity, it’s crucial to consider certain risks. The company’s dependence on climatic conditions and a limited geographical area for revenue generation pose inherent challenges. Moreover, the agri-input sector’s high competitiveness requires Nova Agritech to navigate a dynamic market landscape.

Brokerage Recommendations

Leading brokerages like Swastika Investmart Ltd and BP Wealth have provided positive insights into Nova Agritech IPO. The company’s strong revenue growth, impressive Return on Equity (ROE), and focus on eco-friendly solutions have garnered favorable reviews. Swastika Investmart suggests applying for the IPO, emphasizing the listing benefits, while BP Wealth assigns a “SUBSCRIBE” rating based on Nova Agritech’s financial metrics and growth potential.

Conclusion

The Nova Agritech IPO represents an exciting opportunity for investors to participate in the growth story of an agri-input industry leader. With a robust business model, strategic fund utilization plans, and positive GMP, the IPO is poised for a promising journey. As investors eagerly await the subscription period, the Nova Agritech IPO is set to unlock its potential and contribute to the dynamic landscape of agricultural innovations in India.